Indian Legal System > Civil Laws > Indian Contract Act, 1872 > Section 126: Contract of Guarantee

Guarantee is an undertaking to answer for another’s liability and collateral thereto. It is a collateral undertaking to pay the debt of another in case he does not pay it. It is a provision to answer for the payment of some debt, or the performance of some duty in the case of failure of some person who, in the first instance, is liable for such payment or performance. A Contract of Guarantee means a contract to perform the promises made or discharge the liabilities of the third person in case of his failure to discharge such liabilities.

The words surety and guarantor are used as synonymous terms in Indian law and English Law. But in American law, guarantee is distinguished from suretyship in being a secondary, while suretyship is a primary, obligation; or, as sometimes defined, guarantee is an undertaking that the debtor shall pay; suretyship, that the debt shall be paid. A surety differs from a guarantor, who is liable to the creditor only if the debtor does not meet the duties owed to the creditor; the surety is directly liable. While a surety’s liability begins with that of the principal, a guarantor’s liability does not begin until the principal debtor is in default.

Section 126 of the Indian Contract Act defines four terms as under:

126. ‘Contract of guarantee’, ‘surety’, ‘principal debtor’ and ‘creditor’

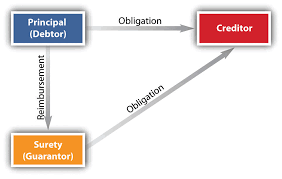

A ‘contract of guarantee’ is a contract to perform the promise, or discharge the liability, of a third person in case of his default. The person who gives the guarantee is called the ‘surety’; the person in respect of whose default the guarantee is given is called the ‘principal debtor’, and the person to whom the guarantee is given is called the ‘creditor’. A guarantee may be either oral or written.

Thus, if A says to B, “Lend Rs. 4,000 to C for one year at interest 12 p.c.p.a. If he does not pay this amount with interest at the end of 1 year, I shall pay it to you.” This is a contract of guarantee.

It involves three parties namely,

- Surety, who gives the guarantee. In the above example, A is a surety

- Principal Debtor, in respect of whose default the guarantee is given. In the above example, C is the principal debtor.

- Creditor, to whom the guarantee is given. In the above example, B is a creditor.

Thus three parties are involved in a contract of guarantee. At the same time, there are three collateral contracts also namely,

- As between B and C [B is giving term loan to C who promises that he would pay].

- As between B and A [A gives a guarantee that on default on part of C, I will pay].

- As between A and C [C indemnifies A in case of C’s default in paying the amount to B).

Essential Elements of Contract of Guarantee:

Should be valid contract:

A contract of guarantee must have all the essentials of a valid contract such as offer and acceptance, intention to create a legal relationship, capacity to contract, genuine and free consent, lawful object, lawful consideration, certainty and possibility of performance and legal formalities.

Concurrence of three parties must:

In a contract of guarantee there must be three parties namely, the principal debtor, the creditor and the surety. In such contract, the surety undertakes his obligation at the request (express or implied) of the principal debtor. All of them must agree to make such a contract.

Written or Oral Contract:

A contract of guarantee may either be oral or written. It may be express or implied from the conduct of parties. Contracts of guarantee have to be interpreted taking into account the relative position of the contracting parties in the backdrop of the contract. The court has to consider all the surrounding circumstances and evidence to come to a finding when the guarantor refutes his liability. It is to be noted that under English Law (the Statute of Frauds (29 Car. II, c.3) Section 4), a Contract of Guarantee must always be in writing.

In P. J. Rajappan v Associated Industries (P) Ltd [1990 (1) All India Banking Law Judgments 321], the guarantor, having not signed the contract of guarantee, wanted to wriggle out of the situation. He contended that he did not stand surety for the performance of the contract. Evidence showed the involvement of the guarantor in the deal, having promised to sign the instrument later. The Kerala High Court held that a contract of guarantee is a tripartite agreement, involving the principal debtor, surety and the creditor. In a case where there is evidence of involvement of the guarantor, the mere failure on his part in not signing the agreement is not sufficient to demolish otherwise acceptable evidence of his involvement in the transaction leading to the conclusion that he guaranteed the due performance of the contract by the principal debtor. When a court has to decide whether a person has actually guaranteed the due performance of the contract by the principal debtor all the circumstances concerning the transactions will have to be necessarily considered. The court cannot adopt a hyper-technical attitude that the guarantor has not signed the agreement and so he cannot be saddled with the liability. Due regard has to be given to the relative position of the contracting parties and to the entire circumstances which led to the contract.

In Mathura Das v Secretary of State (AIR 1930 All 848) and in Nandlal Chanandas v Firm Kishinchand (AIR 1937 Sindh 50), it was held that contract of guarantee can be created either by parol or by a written instrument and that it may be express or implied and may be inferred from the course of the conduct of the parties concerned. There is overwhelming evidence in this case that the second defendant had guaranteed the due performance of the contract by the first defendant, principal debtor. Hence the mere omission on his part to sign the agreement cannot absolve him from his liability as the guarantor.

Liabilities must legally enforceable:

In a contract of guarantee, liability of the surety is secondary i.e., the creditor must first proceed against the debtor and if the latter does not perform his promise, then only he can proceed against the surety. A contract of guarantee pre-supposes the existence of a liability, which is enforceable at law. If no such liability exists, there can be no contract of guarantee. If the debt, which is sought to be guaranteed is already time barred or void, the surety is not liable.

In Manju Mahadev v Shivappa (1918) 42 Bom. 444 case, the Court observed “The word ‘liability’ in Section 126 of the Indian Contract Act, 1872, means a liability which is enforceable at law, and if that liability does not exist, there cannot be a contract of guarantee. A surety, therefore, is not liable on a guarantee for payment of a debt which is statute-barred.”

In Coutts & Co v Brown Lecky and others [1946] 2 All E.R. 207 court held that to be legally effective a guarantee must be given for debt which is enforceable. If the debt is not enforceable, the guarantee will not be enforceable. Thus a minor not being answerable for a debt he incurs, a guarantee for such debt is likewise void.

In State of Maharashtra v Dr. M. N. Kaul, AIR 1967 SC 1634 case, the Supreme Court held that under the law, a guarantor cannot be made liable for more than he has undertaken; a surety is a favoured debtor and he can be bound “to the letter of his engagement”.

Consideration:

There must be consideration between the creditor and the surety so as to make the contract enforceable. The consideration must also be lawful. Section 127 of the Contract Act provides that anything done, or any promise made, for the benefit of the principal debtor may be a sufficient consideration to the surety for giving the guarantee. Thus, any benefit received by the debtor is adequate consideration to bind the surety. A past consideration is no consideration for a contract of guarantee. There must be a fresh consideration moving from the creditor.

In Sonarlinga v Pachai Naicken, (1913) 38 Mad 680; 22 IC 1 case, the Court held that consideration is the legal detriment incurred by the promisee at the promisor’s request and it is immaterial whether there is or is not any apparent benefit to the promisor

In Ram Narain v Lt. Col. Hari Singh, AIR 1964 Rajasthan 76 case, the Court held that A contract of guarantee executed after the contract between the creditor and principal debtor and without consideration is void. It must be contemporaneous with the contract of the creditor and principal debtor. The past benefit to the principal debtor is not a good consideration.

In State Bank of India v Premco Saw Mill, AIR 1984 Gujarat 93 case, the State Bank gave notice to the debtor – defendant and also threatened legal action against her, but her husband agreed to become surety and undertook to pay the liability and also executed a promissory note in favour of the State Bank and the Bank refrained from threatened action. It was held that such forbearance on the bank’s part constituted good consideration for a guarantor.

Disclosure:

The creditor should disclose to the surety the facts that are likely to affect the surety’s liability. The guarantee obtained by the concealment of such facts is invalid. Thus, the guarantee is invalid if the creditor obtains it by the concealment of material facts.

In Muthukaruppa v Kathappudayan (1914) 27 MLJ 249 case, the Court held that The mere fact that A lends money to B on the recommendation of C is no consideration for a subsequent promise by C to pay the money in default of B.

No Misrepresentation:

The guarantee should not be obtained by misrepresenting the facts to the surety.

Difference Between Contract of Indemnity and Contract of Guarantee:

| Contract of Indemnity | Contract of Guarantee |

| It is defined in Section 124 of the Indian Contract Act, 1872 | It is defined in Section 126 of the Indian Contract Act, 1872 |

| It refers to a Contract by which one party promises to save the other from loss caused by conduct of the promisor or another person. | It refers to a Contract to perform the promise or discharge the liability of a third person in case of his default. |

| Its purpose is to compensate losses. | Its purpose is to give assurance to creditor |

| In contract of indemnity there are two parties: indemnifier and the indemnity holder. | In contract of guarantee there are three parties: creditor, the principal debtor and surety. |

| In contract of indemnity, the liability of the promisor is primary. | In contract of guarantee, the primary liability is of principal debtor and the liability of surety is secondary. |

| Contract between the indemnifier and the indemnity holder is express and specific. | Contract between surety and principal debtor is implied and between creditor and principal debtor is express. |

| In Contract of indemnity there is only one agreement i.e. the agreement between indemnifier and indemnity holder. | In contract of guarantee there are three agreements i.e. agreement between the creditor and principal debtor, the creditor and surety and surety and principal debtor. |

| Liability of indemnifier comes into play on contingency of loss happening to promisee | Liability of guarantor exists continuously |

| In Contract if indemnity, the promisor cannot file the suit against third person until and unless the promisee relinquishes his right in favour of the promisor. | In contract of guarantee, the surety does not require any relinquishment for filing of suit. The surety gets the right to file suit against the principal debtor as and when the surety pays the debt. |