Management > Managerial Statistics > Index Number By Fisher’s Method

Laspeyre’s method is based on fixed weights of the base year. For price index base year’s quantities are used as weights. Paasche’s method is based on fixed weights of the current year. For price index, current year’s quantities are used as weights. Fisher has suggested a geometric mean of the two indices (Laspeyres and Paasche) mentioned above so as to take into account the influence of both the periods, i.e., current as well as base periods. Thus Fisher’s Method is a geometric mean of Laspeyre’s index and Passche’s index.

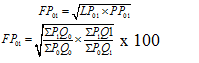

Price Index by Fisher’s Method:

Steps involved:

- Denote prices of the commodity in the current year as P1 its quantity consumed in that year by Q1.

- Denote prices of the commodity in the base year as P0 and its quantity consumed in that year by Q0.

- Find the quantities P0Q0, P1Q0, P0Q1, and p1Q1 for each commodity.

- Find the sum of each column of P0Q0, P1Q0 , P0Q1, and p1Q1 denote the sums by ∑ P0Q0, ∑ P1Q0, ∑ P0Q1, and ∑ P1Q1 respectively.

- Find the Laspeyre’s Price index number

- Find the Paasche’s Price index number

- To find the Fisher’s index number calculate the geometric mean of Laspeyre’s index and Passche’s index.

Laspeyre’s price index

LP01 = (∑ P1 x Q0) / ( ∑ P0 x Q0) × 100

Paasche’s index

PP01 = (∑ P1 x Q1) / ( ∑ P0 x Q1 ) × 100

Fisher’s index number

Example – 01:

Compute Price index by Dorbish and Browley’s Method from the following data.

|

Commodity |

Base Year |

Current Year |

||

|

Price |

Quantity |

Price |

Quantity |

|

|

A |

3 |

25 |

5 |

28 |

|

B |

1 |

50 |

3 |

60 |

|

C |

2 |

30 |

1 |

30 |

|

D |

5 |

15 |

6 |

12 |

Solution:

|

Commodity |

Base Year |

Current Year |

||||||

|

P0 |

Q0 |

P1 |

Q1 |

P0Q0 |

P1Q0 |

P0Q1 |

P1Q1 |

|

|

A |

3 |

25 |

5 |

28 |

75 |

125 |

84 |

140 |

|

B |

1 |

50 |

3 |

60 |

50 |

150 |

60 |

180 |

|

C |

2 |

30 |

1 |

30 |

60 |

30 |

60 |

30 |

|

D |

5 |

15 |

6 |

12 |

75 |

90 |

60 |

72 |

|

Total |

∑P0Q0=260 |

∑P1Q0=395 |

∑P0Q1=264 |

∑P1Q1=422 |

||||

Lapeyre’s Price Index = LP01 = (∑ P1 x Q0) / (∑ P0 x Q0) × 100

LP01 = (395 / 260) × 100

LP01 = 151.92

Paasche’s Price Index = PP01 = (∑ P1 x Q1) / (∑ P0 x Q1) × 100

PP01 = (422 / 264) × 100

PP01 = 159.85

Direct Calculation:

Fisher’s price index is 155.89

Quantity Index by Fisher’s Method:

Steps involved:

- Denote prices of the commodity in the current year as P1 its quantity consumed in that year by Q1.

- Denote prices of the commodity in the base year as P0 and its quantity consumed in that year by Q0.

- Find the quantities P0Q0, P1Q0, P0Q1, and p1Q1 for each commodity.

Find the sum of each column of P0Q0, P1Q0 , P0Q1, and p1Q1 denote the sums by ∑ P0Q0, ∑ P1Q0, ∑ P0Q1, and ∑ P1Q1 respectively. - Find the Laspeyre’s Quantity index number

- Find the Paasche’s Quantity index number

- To find the Fisher’s index number calculate the geometric mean of Laspeyre’s index and Passche’s index.

Laspeyre’s quantity index

LQ01 = (∑ Q1 x P0) / ( ∑ Q0 x P0) × 100

Paasche’s quanity index

PQ01 = (∑ Q1 x P1) / ( ∑ Q1 x P0 ) × 100

Fisher’s quantity index number

Example – 02:

Compute Price index by Dorbish and Browley’s Method from the following data.

|

Commodity |

Base Year |

Current Year |

||

|

Price |

Quantity |

Price |

Quantity |

|

|

A |

3 |

25 |

5 |

28 |

|

B |

1 |

50 |

3 |

60 |

|

C |

2 |

30 |

1 |

30 |

|

D |

5 |

15 |

6 |

12 |

|

Commodity |

Base Year |

Current Year |

||||||

|

P0 |

Q0 |

P1 |

Q1 |

Q0P0 |

Q1P0 |

Q0P1 |

P1Q1 |

|

|

A |

3 |

25 |

5 |

28 |

75 |

84 |

125 |

140 |

|

B |

1 |

50 |

3 |

60 |

50 |

60 |

150 |

180 |

|

C |

2 |

30 |

1 |

30 |

60 |

60 |

30 |

30 |

|

D |

5 |

15 |

6 |

12 |

75 |

60 |

90 |

72 |

|

Total |

∑P0Q0=260 |

∑P1Q0=264 |

∑P0Q1=395 |

∑P1Q1=422 |

||||

Laspeyre’s Quantity Index = LQ01 = (∑ Q1 x P0) / (∑ Q0 x P0) × 100

LQ01 = (264 / 260) × 100

LQ01 = 101.54

Pasche’s Quantity Index = PQ01 = (∑ Q1 x P1) / ( ∑ Q0 x P1) × 100

PQ01 = (422 / 395) × 100

PQ01 = 106.84

Direct Calculation:

Fisher’s quantity index is 104.16

Advantages of Fisher’s Method:

- It is free from bias. It reduces the influence of high and low values of the data.

- This method considers values of both, the current year and the base year.

- Fisher’s index lies between the other two indexes. It is referred to as an “ideal” index because it correctly predicts the expenditure index and it satisfies both the time reversal test as well as factor reversal test.

Disadvantages of Fisher’s Method:

- It is tedious and time-consuming.

- As the data of the current year and the base year is required, the data collection is costly and time-consuming.

Previous Topic: Dorbish and Browley’s Method

Next Topic: Marshall Edgeworth Method

One reply on “Fisher’s Ideal Index Number”

thanks for this good explanation about the Fisher’s method.